According to EIT Food, it is estimated that by 2054, roughly 11% of our global protein consumption will consist of edible insects. This is not just a sign of a growing trend that evolves along with our world, but also a coordinated response to a collective concern.

At Forward Fooding, we believe that the future of food needs to be sustainable, nutritious, healthy and affordable. When talking about alternative proteins, plant-based, fermentation and cell-based products (mostly meat, fish and dairy alternatives) are catching all the light with more than 1,000 companies working in this field and funding of $4.5B in 2021. Yet, insects are also emerging as a key trend and promising alternative.

How sustainable and scalable are insect protein products? This article explores the state and trajectory of the insect protein industry, presents companies operating in this space, and outlines the challenges of the sector.

According to Fortune Business Insights, the global insect protein market is projected to grow from $153.92 million in 2021 to $856.08 million by 2029, showing a CAGR of 24.1%, and is currently divided into 3 main market applications.

Human consumption of insects

Historically to date, in the western world, insects have been primarily used as a source of protein for animal feed and pet food, yet it is now also starting to emerge as a sustainable alternative for human consumption as well. FAO has estimated that entomophagy, the specialized term for eating insects, is already common for about 2 billion people in the world, substantially in Asia, Central America and Africa. Insects can be consumed at all stages of growth, including eggs, larvae, pupae and adults. According to FAO report, more than 1,900 species of insects are consumed, mostly in tropical countries, with beetles (31%), caterpillars (18%) and bees, wasps and ants (14%) being the top 3 most consumed edible insects species. Insects are also being cataloged as a food source of high nutritional value and, compared to meat or fish, they contain a greater amount of micro and macronutrients. In particular, insects are great sources of proteins, amino acids, fiber and minerals such as copper, iron, magnesium, phosphorus, manganese, selenium, and zinc.

Animal feed consumption

The production of animal feed consumes some 6 billion tons of fodder and grains every year. In fact, it is estimated that 45% of the world’s grain production is used for livestock. In practice, these figures have major consequences including the extensive use of arable land that can affect the quality of water and watersheds, generate a loss of native habitats and exacerbate the spread of invasive species, among other things. The urgency to find a replacement for traditional animal feed has fuelled the push for recognizing insect protein as a suitable alternative.

Biofertilizers

The excessive use of chemical and artificial fertilizers has led to several issues, such as serious soil degradation, nitrogen leaching, soil compaction, reduction in soil organic matter, and loss of soil carbon, while their efficiency on crops has been decreasing over time. Alternative sources of natural and organic fertilizers are now available and starting to get traction, such as insect frass fertilizer. In addition to being an efficient biofertilizer, frass also preserves soil fertility by decreasing leaching and infiltration and reducing the prevalence of disease and pathogens.

Sustainability aspects

Insect protein used for human consumption appears to offer several environmental benefits, and according to FAO, much more than meat. Here are some of the main reasons:

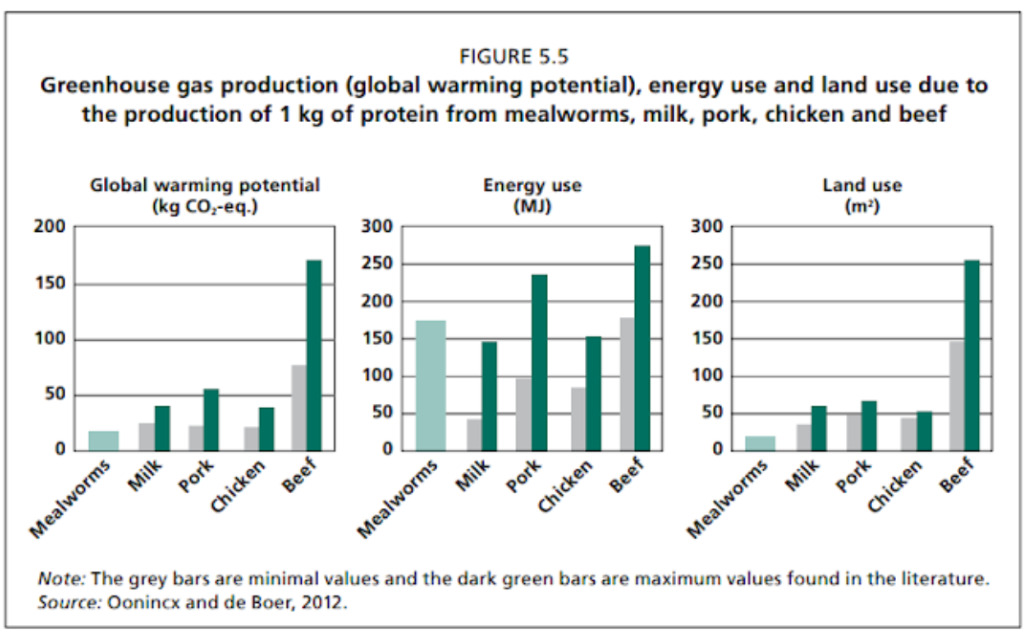

- Lower CO2 emissions: Broiler chickens produce 32–167% higher emissions, and beef cattle emit 6– 13 times more CO2 equivalents when compared to mealworms on an edible protein basis

- Lower water consumption: The production of insect protein requires 5 times less water, compared to edible protein from beef.

- Great adaptability to the circular economy: you can feed insects from crop farming or food production and then turn it into valuable output via their biomass.

- Production efficiency is much higher since insects can convert 2 kg of food into 1 kg of insect mass, while in livestock farming it takes around 8 kg of grains to generate 2 kg of meat.

- Lower occupation of farm space: producing insects requires approximately 3.5 m2 per kg of insect protein, whereas 250 m2 is used per kg of beef protein.

Source: Oonincx and de Boer

The above study (dating from 2012 but still relevant) established that energy usage for the production of 1 kg of mealworm protein was lower than for beef, comparable with pork, and slightly higher than for chicken and milk. GHG emissions due to mealworm production were much lower than for the more common production animals. For every 1ha of land required to produce mealworm protein, 2-3 times more land would be required to produce a similar quantity of milk protein, pork, or chicken protein, and 10 times more land would be required to produce a similar quantity of beef protein.

AgriFoodTech startups working on insects

So how are AgriFoodTech entrepreneurs embracing this growing trend? In the last 10 years, according to our FoodTech Data Navigator, more than 200 companies making insect food products for human consumption, animal feed and biofertilizers were established, mainly in Europe, South Asia and North America.

In terms of funding, with over $600M invested globally, 2021 marked a record-breaking year in AgriFoodTech investment, with a 50% increase over 2020. Such exponential growth in 2020, despite being driven mostly by Ynsect’s record round, signals a growing interest in the segment which was followed in 2021 as well.

Source: FoodTech Data Navigator

Increasing demand for high protein (consumption increased 40% globally between 2000 to 2018) and low fat, along with shifting trends in dietary needs is likely to stimulate the market further.

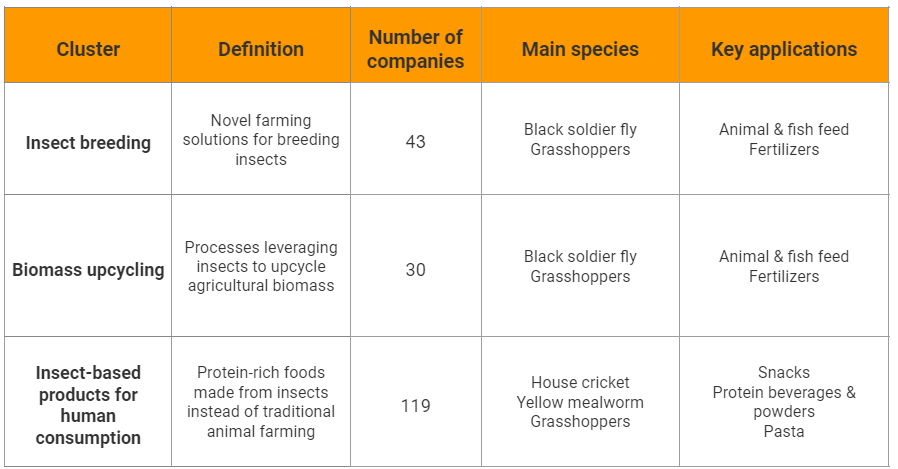

Technology-wise, we can split the ecosystem into 3 main ‘clusters’ of companies:

Source: FoodTech Data Navigator

Let’s deep dive into some of the main companies operating in this space.

Insect breeding

Ynsect (#3 of the 2021 FoodTech 500)

Ÿnsect is a world leader in insect protein and fertilizer production. Founded in 2011 in France by scientists and environmental activists, this company transforms insects into a premium, high-value ingredients for pets, fish, plants, and human beings. Ÿnsect is currently building its second production unit, the largest vertical farm in the world, in Amiens after raising a record-breaking $425 million in funding.

Through the years, the company made key partnerships to continue growing and expanding. In 2021, they entered the US market and also acquired Protifarm, a Dutch mealworm manufacturer, to strengthen their position in the human consumption market. Moreover, they have 40+ financial, research, institutional and project partners.

Ynsect

Antoine Hubert, CEO and co-founder at Ynsect, clarifies the key benefits of partnering with other larger companies:

“Reinventing our food systems will require large-scale change at every level, so they are key. The audience, impact, and power of large corporations are impossible to deny, so high-potential, smaller industry players offering innovative solutions for the food industry would do well to collaborate with pertinent large corporations to scale up their impact. Change never comes from a single actor. For example, our partner Zirp Insects (who use our products as an ingredient) have recently partnered with Billa supermarkets, the second-largest supermarket chain in Austria, to amplify their impact across the country and make the products as accessible as possible to the mainstream.”

Protix (#12 of the 2021 FoodTech 500)

Founded in 2009 in the Netherlands, Protix is a manufacturer and supplier of insect ingredients for both animal feed and for human consumption. It processes and supplies high-quality ingredients based on the black soldier fly.

Protix

The company currently operates the world’s largest insect factory and recently raised €50M for international growth, with investments coming from the European Circular Bioeconomy Fund (ECBF), BNP Paribas, The Prince Albert II of Monaco Foundation, and The Good Investors.

Biomass upcycling

Innovafeed

InnovaFeed is another French biotechnology company founded in 2016, that develops insect-based ingredients (protein and oil) for animal & fish feeding and upcycles frass as an organic fertilizer, derived from the Black Soldier Fly. What sets InnovaFeed apart from other insect manufacturers is that the company has implemented a fully integrated automated system to optimize production, powered by 100% green energy, including 60% waste energy from a wood biomass turbine, with the remaining 40% coming from a power station using renewable resources. If you want to know more about their industrial symbiosis model we recommend you to watch their short video about it here.

In terms of high-level partnerships, this year, Cargill and Innovafeed decided to continue their cooperation, to help increase the production of healthy new constituents for aquafarmers, and combining Innovafeed’s knowledge in formulating insect ingredients and Cargill’s global animal nutrition capabilities to gauge the use of insect ingredients in diverse types of animal feed.

Better Origin (#150 of the 2021 FoodTech 500)

Better Origin helps farmers and supermarkets reach net zero by transforming food waste into animal feed with the world’s first AI-powered insect “mini-farms” in shipping containers, which farmers can deploy on-site to upcycle agri-food waste and turn it into animal feed.

Better Origin

This UK startup founded in 2015, has recently raised $16 million in fresh funding, with the objective of expanding to the rest of Europe.

Insect-based products for human consumption

Small Giants

Founded in 2017, Small Giants is a UK pioneer in the development of insect-based food products, offering 3 different flavors of crackers, using 15% cricket flour.

Its latest investment round €470K , is focused on developing new products and helping the company’s expansion in the UK and Europe. Most of the investment came from shareholders and partners of iN3 Ventures’ network, an innovation advisory and corporate venture capital firm.

Small Giants

Aspire Food Group

Founded in 2014, the Canadian company Aspire Food Group is one of the pioneers in the field of sustainable insect agriculture. They manufacture a variety of food products made from crickets. They have raised a total of $21.6M in funding over 3 rounds to date and acquired EXO, a company producing protein bars made from crickets.

They recently expanded into London with their new massive cricket-processing facility. The London plant will produce 12 million kilos of crickets each year, at what’s believed to be the biggest cricket-specific processing facility in the world, and focusing mainly on the pet-food market.

Yumbug

Yum Bug is a UK startup on a mission to take edible insects mainstream. Launched during the lockdown, they offer insect-based recipes and meal delivery kits, with an easy way to cook delicious insect meals at home. Yum Bug now sells its kits directly to consumers through its website and in a range of whole food stores across London.

Yumbug

Challenges for the insect protein industry

Social aspects: the ick factor

Despite its positive environmental impact, many obstacles hinder the advancement of this industry. Much of the concern is typically raised with regard to whether Western society can adapt to the consumption of insects as a protein source.

Whilst direct consumption may remain an issue, public perceptions regarding the use of insects in animal feed is changing for the better, although not consistently. 72.6% of people (made to people from all around the world with the top five responses from the UK, Mali, China, Poland and France), conducted as part of the ProteInsect project, would be willing to eat fish, pork or chicken which were raised on diets on an insect protein diet and 65.8% said they thought that fly larva are a suitable source of animal feed protein.

Another survey, conducted in the UK by the Food Standards Agency, revealed that only half of the consumers perceived insects as safe to eat and just 26% said they would be willing to try insects.

This shows that while there is still a significant stigma related to the direct consumption of insects by humans, this does not carry over to animal feed. Thus, consumer acceptance, in addition to the legislative hurdle and the high prices, remains one of the major barriers to including insects as protein sources in many Western countries.

High costs to produce insect protein

The edible insect trend has grown in the past few years, but still remains a niche. High costs of production are still impacting the demand, and innovation and investments are necessary to scale up the production.. As a matter of fact, the price of insects used in animal feed can be 3x higher than fishmeal and soy protein.

On the human consumption side, sustainability is one of the strongest aspects to justify the prices and the transition to insect protein intake. Yet, experts state that a strong marketing strategy is also necessary. It’s essential for startups, producing insect protein for human consumption, to eliminate the “ick” factor, raise awareness and educate about the importance of new sources of protein as insects.

But even though companies are innovating and trying to educate their consumers, regulations are still a strong hurdle.

Jimini’s is a French brand that produces “ready-to-eat” insects and 100% natural insect-based high-energy bars.

Safety and legislation

More and more companies are innovating in the sector, but regulations aren’t moving forward at the same speed as entrepreneurs.

Regulation is not keeping pace because production methods, safety standards, and insect species may vary in each country, while globally recognized food safety standards are established for meat, poultry, and fish food.

The possibility of biological diseases in food and feed products derived from insects would depend on production methods, what the insects are fed on, insect species and many other aspects. As a consequence, there is no ‘one-size-fits-all’ solution that currently exists for regulating the industry. These regulatory demands and differences between countries complicate the international strategies for the commercialization of insect products.

Furthermore, to the ‘general food hygiene requirements, the production and marketing of insects for human consumption in Europe is controlled by the ‘Novel Foods’ legislation. This legislation applies to all orders of foods that ‘were not used for human consumption to a significant degree within the European Union, which is the case of insects. European member states have lately approved house crickets, yellow mealworms and grasshoppers as so-called ‘novel foods’ which provide regulation to be brought to market. Also the lesser mealworm, after the EFSA permission, is waiting for the European Commission to be accepted for human consumption.

On the other hand, in the US, insect production is currently subject to approval from the U.S. Food & Drug Administration. To be allowed for the market, insects must have been bred for human consumption and of course, follow the standards required by the FDA. The label on the product must include the common name and the insect’s scientific name, and note the possible risks of allergy.

What’s next?

According to the Food and Agriculture Organization of the United Nations (FAO), insects have great potential to be sustainable and economic sources of protein, but a huge barrier standing in their way is consumer perception.

We surely need more education, marketing efforts and collaborations with large corporations, to introduce insect protein to consumers. But without regulatory permits, the number of startups willing to explore this sector remains limited.

Clement Scellier, Co-founder at Jimini’s reaffirms the idea that changing the food system is not possible alone, and that we need that all actors to act to make it happen:

“We regularly collaborate with major players in the food industry such as the PepsiCo group, Carrefour, Kaufland or smaller structures that are just as influential in the development of food trends, such as the Grande Epicerie de Paris, Foodchéri or Kazidomi. Insects are still considered as a fantasy, futuristic or even bizarre novelty, but there are serious players who are watching the startups lead the way. The occasional or long-lasting collaborations with big companies give credit to our market and allow us to gain visibility, an important point for a type of product that can scare first-time consumers.”

It is urgent to switch up the way we grow, share and consume our food. Today we can celebrate that the lesser mealworm is the fourth insect to receive the assessment. But let’s continue redesigning our food system making true collaborations between the different actors of the FoodTech Ecosystem!

Do you want to learn more about the FoodTech sector? Access our Food Data Navigator HERE to discover all the companies mentioned in this article and gather trends and insights, or get in touch HERE for a tailored consultancy.